The Basic Principles Of Paul B Insurance

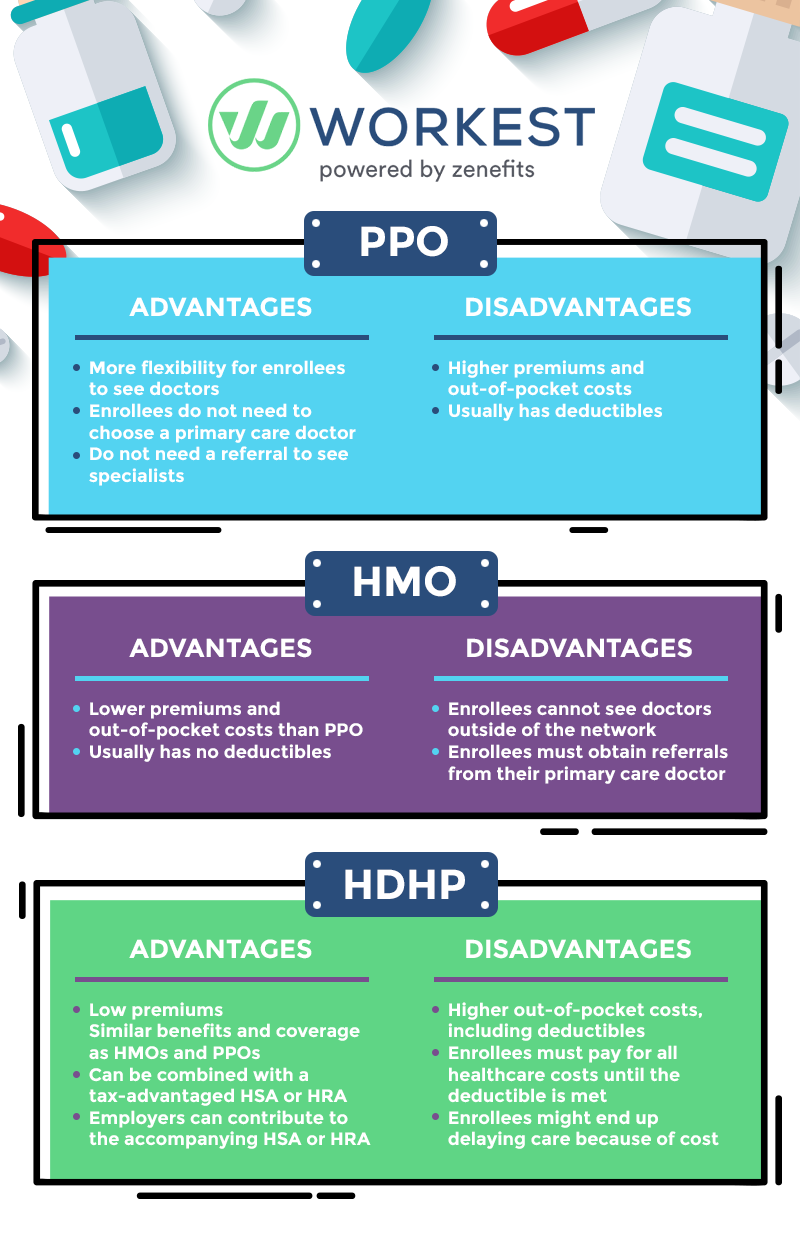

An HMO might need you to live or operate in its service area to be eligible for insurance coverage. HMOs typically supply incorporated treatment and also focus on prevention and also health. A kind of plan where you pay much less if you use physicians, hospitals, and also various other wellness treatment service providers that come from the plan's network.

A type of health insurance plan where you pay much less if you use service providers in the plan's network. You can make use of doctors, medical facilities, as well as carriers outside of the network without a referral for an extra expense.

, and also platinum. Bronze plans have the least protection, as well as platinum plans have the most.

Facts About Paul B Insurance Revealed

If you see a medical professional who is not in the network, you'll might have to pay the complete costs on your own. This is the cost you pay each month for insurance policy.

A copay is a level fee, such as $15, that you pay when you get treatment. These costs differ according to your plan as well as they are counted towards your insurance deductible.

Greater out-of-pocket prices if you see out-of-network doctors vs. in-network suppliers, Even more documents than with other strategies if you see out-of-network companies Any type of in the PPO's network; you can see out-of-network physicians, however you'll pay more. This is the cost you pay every month for insurance. Some PPOs may have an insurance deductible.

Fascination About Paul B Insurance

A copay is a level charge, such as $15, that you pay when you get treatment. Coinsurance is when you pay a percent of the fees for care, for instance 20%. If your out-of-network doctor bills greater than others in the location do, you might have to pay the balance after your insurance pays its share.

This is the cost you pay each month for insurance coverage. A copay is a flat charge, such as $15, that you pay when you obtain care.

This is the price you pay each month for insurance policy. Your plan may require you to pay the amount of an insurance deductible before it covers care past precautionary solutions.

The Ultimate Guide To Paul B Insurance

We can not avoid the unexpected from taking place, however occasionally we can safeguard ourselves as well as our families from the most awful of the monetary fallout. Picking the appropriate type and also amount of insurance coverage is based upon your particular scenario, such as children, age, lifestyle, as well as employment benefits. Four types of insurance coverage that the majority of economists recommend include life, health and wellness, vehicle, and long-lasting special needs.

It includes a survivor benefit and additionally a cash money worth element. As the value grows, you can access the cash by taking a finance or taking out funds and you can end the policy by taking the cash worth of the plan. Term life covers you for a collection quantity of time like 10, 20, or three decades and also your costs continue to be steady.

2% of the American populace was without insurance protection in 2021, the Centers for Condition Control (CDC) reported in its National Center for Health And Wellness Statistics. Even more than 60% obtained their insurance coverage with an employer or in the private insurance market while the rest were covered by government-subsidized programs including Medicare as well as Medicaid, experts' benefits programs, as well as the federal industry established under the Affordable Care Act.

The Best Strategy To Use For Paul B Insurance

Investopedia/ Jake Shi Check Out Your URL Long-term special needs insurance policy supports those that end up being incapable to work. According to the Social Protection Administration, one in 4 employees going into the labor force will end up being handicapped before they get to the age of retired life. While medical insurance spends for a hospital stay and clinical costs, you are often burdened with every one of the costs that your income had actually covered.

This would be the visit their website finest choice for protecting budget friendly disability coverage. If your employer doesn't offer long-term YOURURL.com protection, below are some points to think about before buying insurance on your very own: A plan that ensures earnings substitute is optimum. Many policies pay 40% to 70% of your revenue. The expense of handicap insurance is based on many factors, including age, way of living, and wellness.

Nearly all states require motorists to have vehicle insurance and also the couple of that do not still hold drivers monetarily in charge of any kind of damages or injuries they cause. Right here are your choices when purchasing vehicle insurance coverage: Obligation coverage: Pays for property damage and injuries you create to others if you're at fault for a crash and also covers lawsuits costs and judgments or negotiations if you're taken legal action against as a result of an automobile accident.

Paul B Insurance Can Be Fun For Anyone

Employer protection is commonly the most effective option, but if that is inaccessible, obtain quotes from several suppliers as lots of provide discounts if you buy greater than one kind of coverage.

When comparing plans, there are a few aspects you'll want to take right into consideration: network, cost and also benefits. Consider each plan's network and identify if your favored carriers are in-network. If your medical professional is not in-network with a strategy you are thinking about but you intend to remain to see them, you may wish to take into consideration a different strategy.

Try to discover the one that has the most benefits and any kind of particular doctors you need. You can transform wellness strategies if your employer offers more than one plan.

Not known Facts About Paul B Insurance

You will certainly need to pay the costs yourself. ; it may cost much less than specific health and wellness insurance policy, which is insurance policy that you buy on your very own, and also the advantages might be better. If you get Federal COBRA or Cal-COBRA, you can not be refuted insurance coverage because of a clinical condition.

You may need this letter when you obtain a brand-new group wellness plan or apply for an individual wellness strategy. Individual health and wellness strategies are strategies you get on your own, for on your own or for your household.

Some HMOs use a POS strategy. If your carrier refers you beyond the HMO network, your prices are covered. If you refer on your own beyond the HMO network, your coverage may be refuted or coinsurance required. Fee-for-Service plans are usually taken typical strategies. You can purchase the strategy, and afterwards you can see any kind of doctor at any type of facility.